Governance is the backbone of effective portfolio management. Yet, many organizations rely on outdated processes that hinder agility, clarity, and alignment. Traditional approaches often involve slow approvals, excessive documentation, and rigid timelines which can obstruct timely responses to changing market conditions. The result is misaligned initiatives, wasted investments, and teams struggling to see how their work connects to broader business goals.

By integrating Artificial Intelligence (AI) into portfolio management, leaders can leverage real-time data analysis, predictive insights, and workflow automation to modernize governance and sharpen strategic focus.

This article explores how an AI-powered approach to portfolio management is transforming traditional governance models, aligning investments more closely with organizational priorities, and creating the flexibility needed in today's dynamic environments. We also introduce how enlisting expert consultants, like Agile Velocity, help to guide this transition in a meaningful way.

The Struggle with Modernizing Portfolio Management

Many enterprises struggle with bureaucratic governance frameworks. Teams often feel disconnected from strategic objectives and decision-makers sometimes find it difficult to adapt plans promptly based on data. This disconnect can lead to confusion, missed opportunities, and significant project overruns.

Integrating AI enables organizations to analyze data as it comes in and derive insights that inform funding and risk assessments. Whether it's rebalancing budgets, reprioritizing tasks, or automating routine reporting, AI can reduce administrative burdens and free leaders to focus on high-value activities. In parallel, visualization tools can provide a clear picture of progress and signal where bottlenecks may arise--helping ensure that work remains aligned with strategic goals.

The Impact of AI on Portfolio Governance

Effective governance requires that decisions are transparent, data-informed, and consistently aligned with strategy. Traditional methods--characterized by lengthy documentation and slow feedback loops--can delay responses to emerging issues.

Advanced AI-powered dashboards aggregate data from multiple sources and support a proactive approach. For instance, insights drawn from real-time data can help leadership identify potential issues quickly and adjust priorities, even though the idea of "on-demand insights" is an interpretation of these broad capabilities rather than a specific, directly verified claim. Similarly, Gartner's research generally underscores that AI's ability to provide immediate data analysis can enhance decision-making and operational efficiency.

Agile practices further contribute to modern governance by emphasizing responsiveness and iterative improvements. When combined with AI tools, these methodologies help ensure that portfolios remain responsive to both market shifts and internal performance metrics.

Research Insights from Leading Sources

In the following sections, we'll examine insights from leading industry sources on the potential impact of AI on portfolio governance. These include research from the Harvard Business Review and an MIT and McKinsey study, all of which explore the potential of AI to drive efficiency, improve decision-making, and align investments with business goals. While the specific findings presented should be interpreted in the context of each organization's unique environment and innovation roadmap, these resources offer valuable guidance for leaders seeking to leverage AI in their portfolio management efforts.

Harvard Business Review Findings

Research published in Harvard Business Review suggests that integrating AI into core business processes can drive improvements in efficiency and decision-making speed.

The findings show that many companies are using AI tools to support sales and customer engagement in a variety of ways. For example, Microsoft's "Daily Recommender" system provides timely, data-driven suggestions to sales teams based on customer interactions, resulting in a 40% increase in sales productivity through improved lead conversion and more time spent with clients. Similarly, Morgan Stanley leverages verbal-visual AI to enhance content creation by summarizing client communications, generating personalized proposals, and producing relevant talking points. Their AI Assistant also helps advisors quickly access insights from over 100,000 internal documents, enabling more efficient and informed client interactions.

McKinsey Insights

MIT and McKinsey's research on AI and business alignment reflects that companies effectively using AI in key operational areas can experience benefits such as enhanced return on investment and improved process efficiencies.

The findings show that many companies are beginning to unlock significant value from generative AI, particularly in operations, despite early challenges with integration and scale. For instance, a top 10 global retailer deployed an in-store chatbot across nearly 2,000 locations, allowing store associates to quickly access best-practice manuals and reducing time spent on internal support calls--ultimately streamlining training and easing the impact of employee turnover. In another case, a global pharmaceutical company implemented a generative AI tool to analyze supplier invoices, achieving 95% accuracy in extracting line items from PDFs. Within just four weeks, the system uncovered over $10 million in value leakage--about 4% of the spend analyzed--and flagged recurring purchases not covered by contracts, creating opportunities for renegotiation.

These examples reflect a broader trend: the latest research shows that performance improvements for AI leaders are now 3.8 times greater than those of lagging companies, up from 2.7 times in earlier studies.

The Potential and Future Trends of AI in Portfolio Management

As organizations seek to embrace innovation and stay competitive in today's fast-paced business landscape, the integration of Artificial Intelligence into portfolio management emerges as a pivotal strategy. AI can help revolutionize how investments are managed by enhancing efficiency, providing real-time insights, and ensuring strategic alignment with business objectives. By predicting trends and automating routine operations, AI not only streamlines governance processes but also prepares organizations for future challenges. This section explores the vast potential of AI in transforming portfolio management practices and outlines the trends that are likely to shape its evolution in the coming years.

AI offers a suite of capabilities that include:

Real-Time Dashboards and Predictive Analytics

AI systems can aggregate disparate data and assist in forecasting potential risks and investment returns. For example, predictive analytics tools may help in anticipating various risks and support the prioritization of initiatives with the highest potential impact.

Advanced Machine Learning and Scenario Planning

Looking forward, experts expect that as AI becomes more nuanced, it will provide prescriptive guidance--helping decision-makers test multiple hypothetical scenarios or resource constraints before committing to a course of action. This forward-looking perspective implies enhancements such as improved scenario planning, natural language processing to extract insights from unstructured data, and increased customization of AI solutions to a company's specific environment. These anticipated trends are evolving and may not yet be fully standardized, but they represent directions in which the industry is moving.

Addressing Traditional Lean Portfolio Management Challenges with AI Integration

Traditional Lean Portfolio Management is often impeded by rigid funding cycles, exhaustive approval protocols, and delayed feedback mechanisms. These limitations can stifle agile responses to market signals. Modern AI applications for portfolio management promise to alleviate these issues by automating data collection and analysis, thus reducing overhead and allowing for continuous course correction.

Strategic Insights for Implementation

For organizations considering the integration of AI into their portfolio management strategies, several key considerations emerge:

-

Data Integration and Real-Time Analytics: Building a robust data infrastructure that aggregates information from various sources is critical. This platform should support real-time dashboards that empower decision-makers to monitor trends and respond promptly.

-

Predictive and Prescriptive Analytics: While predictive analytics can help forecast risks and potential returns, combining these with prescriptive analytics may support the reallocation of resources toward initiatives with higher impact.

-

Cultural and Operational Alignment: Integrating AI requires not only technological upgrades but also a shift in governance and decision-making practices. This includes developing change management processes that help teams adapt and validate AI-generated insights through iterative feedback loops.

With these considerations often comes common challenges that need to be recognized and addressed:

Challenge 1: Clarity of the AI Purpose and Ownership

The most common stumbling block for organizations isn't technology failure but lack of clarity--specifically, unclear purpose or ownership of AI initiatives. Your organization must have a clear map of all AI projects, defined business objectives, and assign clear accountable owners. In addition, there must be facilitated cross-functional deep-dives to root out duplicated or contradictory efforts--a step too often skipped, leading to wasted resources and strategic drift.

Challenge 2: Organizational Readiness - Analyzing if Your Team is Prepared for AI Adoption

Before AI implementation, you must conduct an organizational readiness assessment. Utilizing a consultant for this analysis can be invaluable for strategic execution. A hands-on guide with deep expertise will systematically guide the organization through a readiness assessment.

This often begins with hard decisions on which performance metrics truly matter and ensuring data can be reliably collected at scale. Policy frameworks need to be created to govern both the ethical and practical use of AI. Scenario-driven training sessions may be created for every user group so they know which AI tools are to be used and how to properly use them.

This assessment is incredibly important for spotting any organizational blind spots that will undermine your project. Is your team ready?

Quick Checklist: Is Your Organization Ready for AI?"

-

Do you have defined success metrics?

-

Is data quality and accessibility validated?

-

Are AI usage policies established and communicated?

-

Do you have a training plan in place for all users?

-

Have validation checkpoints been defined?

If your answer is "No" for most, or all of these quick questions, you should consider the possibility of seeking guidance for proper integration so that your team can truly reap the benefits of using AI for lean portfolio management.

Challenge 3: Knowing What Metrics and Indicators to Track When Implementing AI-Driven Governance

Effective AI-driven governance means quantifying the delta between policy and actual practice. Your organization needs to deploy models that automatically surface where governance protocols (like SDLC) break down, highlighting compliance gaps in real time.

Key metrics include policy adherence rates, identification of process variances, and the number/frequency of AI-generated alerts.

Having expert guidance is critical for navigating the complexities of AI adoption. Seasoned professionals bring a deep understanding of both the technical landscape and organizational pitfalls--such as misaligned AI initiatives, overlapping efforts, or inadequate policy alignment--that frequently derail projects. With targeted expertise, businesses can proactively identify risks, clarify goals, streamline processes, and implement robust governance, ensuring AI investments deliver measurable value rather than costly confusion.

AI's Impact on Different Stakeholders in Portfolio Management

AI's integration into portfolio management stands to revolutionize the roles and responsibilities of various stakeholders, including decision-makers, team leads, and financial officers. By providing advanced analytical capabilities and automation, AI enables these stakeholders to make more informed decisions, streamline operations, and align initiatives more closely with strategic goals. In the next sections, we will delve deeper into how AI reshapes the landscape for each stakeholder, enhancing their ability to navigate complexities and capitalize on emerging opportunities.

Decision-Makers

AI can significantly enhance the capabilities of decision-makers in an organization:

-

Data-Driven Decisions: With AI-driven analytics, decision-makers can leverage real-time data and predictive insights to make more informed and timely decisions.

-

Faster Adaptation: AI allows decision-makers to quickly adjust strategies in response to changing market conditions.

-

Strategic Focus: Automation of routine tasks by AI frees up decision-makers to concentrate on high-strategic value activities and long-term planning.

Team Leads

Team leads benefit from AI in terms of improving team coordination and project execution:

-

Clear Alignment: AI helps ensure team efforts are closely aligned with broader business objectives by providing insights into project progress and potential bottlenecks.

-

Enhanced Communication: AI-driven tools facilitate better communication and collaboration, offering dashboards that keep team members updated.

-

Efficient Resource Allocation: AI can assist in dynamically prioritizing tasks and reallocating resources to the most impactful projects.

Financial Officers

For financial officers, AI offers enhanced financial oversight and strategic guidance:

-

Optimized Budgeting: AI's advanced analytics allow for more accurate forecasting and budget allocation which align investments with business priorities.

-

Risk Mitigation: AI tools can identify trends and potential financial risks early, enabling proactive measures.

-

Increased ROI: Enhanced decision-making and resource management result in improved financial performance and return on investment (ROI).

Each stakeholder, by harnessing the capabilities of AI, can contribute to a more Agile, efficient, and strategically aligned organization, ultimately transforming traditional governance models to meet modern demands.

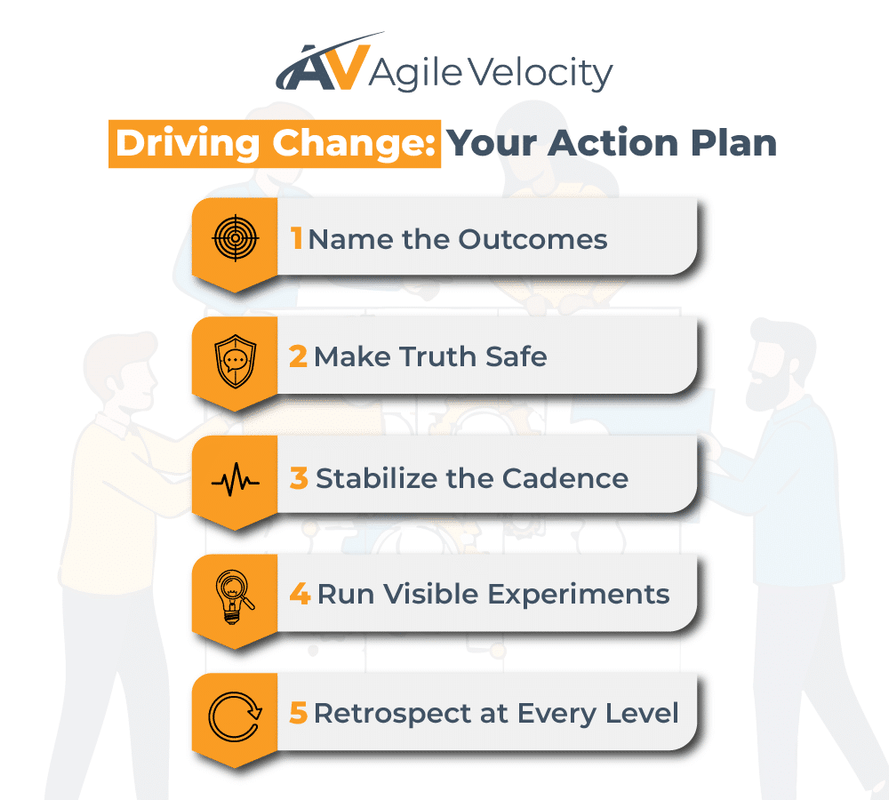

Agile Velocity: Pioneering AI and Lean Portfolio Management

Agile Velocity is at the forefront of helping organizations transform traditional governance with AI implementation and integration solutions. By leveraging Agile methodologies, they ensure a smooth and adaptive implementation process, allowing companies to harness the full potential of AI without disruptions. They also help facilitate iterative development and continuous improvement, ensuring AI systems evolve to meet changing demands.

-

Custom AI Implementation: Agile Velocity tailors AI integration to align with organizational goals and frameworks, ensuring that AI tools effectively cater to specific business needs.

-

Define Metrics: Agile Velocity helps to define what metrics matter and streamline complex systems to enable high-quality data capture.

-

Policy Development and Training: Agile Velocity helps to create and socialize clear policies covering AI tools and uses, along with facilitating training with real usage examples.

-

Establish a "Trust-but-Verify" Culture: Agile Velocity rigorously promotes a 'trust but verify' ethos--educating teams to routinely validate AI outputs and not assume infallibility.

Lean Portfolio Management Solutions

As organizations grapple with complex portfolio management challenges, Agile Velocity offers lean solutions that streamline operations and foster strategic alignment.

-

Adaptive Planning: They implement Lean Portfolio Management practices that prioritize flexibility and responsiveness, allowing teams to swiftly adapt to market changes.

-

Continuous Feedback Loops: By embedding a feedback mechanism within the portfolio management process, Agile Velocity ensures that insights derived from AI are continuously recalibrated for maximum efficacy.

-

Value Stream Mapping: Agile Velocity's consulting practices include value stream mapping to identify and eliminate waste, enhancing overall portfolio efficiency and improving resource allocation.

Benefits of Partnering with Agile Velocity

Organizations partnering with Agile Velocity to implement AI and lean portfolio management gain a competitive edge through:

-

Enhanced Decision-Making: Real-time data analysis provided by AI tools leads to quick, informed decisions that align with business objectives.

-

Improved Efficiency: Streamlined processes reduce overhead, allowing teams to focus on high-value objectives.

-

Strategic Agility: Agile Velocity's approach ensures businesses remain agile, adapting to technological advancements and market shifts seamlessly.

Agile Velocity's comprehensive suite of services makes them an ideal partner for organizations looking to integrate AI solutions and advance their portfolio management strategies through lean, agile approaches.

Harnessing AI for Future-Ready Portfolio Management

AI Powered Portfolio Management holds significant promise in modernizing governance and driving strategic alignment. By leveraging real-time data analytics and predictive insights, organizations can overcome the delays and rigidity of traditional governance models.

By embracing AI as one component of an integrated, agile approach to portfolio management, companies can better position themselves to manage risks, optimize resource allocation, and ultimately drive improved business outcomes.

To learn how AI can support your strategic initiatives, explore our advanced solutions and consulting services tailored to modern portfolio management needs.

Ready to Drive Success?

Take the first step towards unparalleled agility and growth by requesting a meeting to explore how Agile Velocity can help your organization thrive.